Nintendo - Switching the business model

In this post, I talk about my thoughts on Nintendo and why the business is misunderstood by investors and the Street. Disclaimer: This post doesn't constitute as a buy or sell recommendation.

Nintendo was originally founded in 1889 manufacturing hanafuda (handmade playing cards). Their craftsmanship and quality of production made their products a hit with Japanese consumers. Unfortunately, these same qualities led increasing sales by their main customer base, the Yakuza, which soon alienated them from general consumers. Faced with their first existential crisis; the company stumbled across other avenues such as taxi services and producing instant rice. However, one man, Gunpei Yokoi, was pivotal in helping Nintendo reinvent themselves into a successful toy manufacturer. Gunpei’s philosophy of “lateral thinking with withered technology” (taking cheap technology and find new uses) is still instilled into the culture of the company today. Over the years, the company has been able to extend their manufacturing prowess into the video game market and, faced with another opportunity, are reinventing themselves once again. This time, they are transforming their cyclical console driven business model to a global entertainment and IP licensing house.

Switching it up

“Apple and Nintendo have similar philosophies” Miyamoto, 2016

From the release of the Gameboy creating the portable gaming segment to the Wii utilising motion controls, Nintendo has a rich history of pushing boundaries with each console release. The Switch release is no exception – the console provides gamers with the best of both worlds; playing your favourite titles in the comfort of your home and continuing your progress while on the go. Unlike previous Nintendo consoles that operated solely within either the home console or portable console segment, the Switch operates within both and appeals to gamers that prefer either segment and addresses a larger market than previous Nintendo consoles.

Meanwhile, with COVID and working-from-home, Switch adoption has accelerated with the consoles flying off the shelves. And whilst many people mistakenly perceive Xbox (owned by Microsoft) and PS series (owned by Sony) as competitors, the NPD group survey states that over 70% of switch owners actually own an Xbox, PS4 or both. Due to its unique appeal, the Switch attracts a different segment of gamers; Switch owner demographics skew 50% female which is higher than 42% for the Xbox One and PS4.

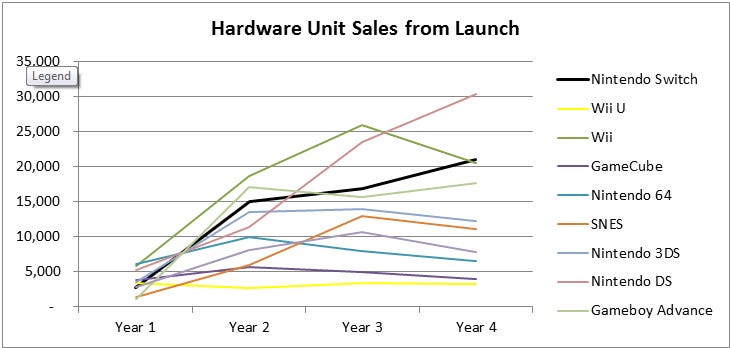

However the big issue within the console market is that product life cycles typically last between 5-10 years. Hardware revenue streams are highly variable through the cycle; sales peak after a couple of years and start to taper down as the product starts to show its age. Software sales typically mirror the performance of its hardware. The success of each new cycle depends on the launch of each new product and its customer reception.

Consoles are typically sold at a loss/breakeven to maximise the number of installed base and profits are instead made from software sales. Software sales experience extremely high operating however its success is dependent on the size of the installed base (i.e. if the consoles release flops, then software sales will likely flop). Whilst this has proven to be fruitful when a console release is a success (such as the Wii in 2011 and the DS in 2012), this has the opposite effect when reception is poor (e.g. Wii U). Historically, games aren’t backwards or forwards compatible (cannot be played on future or past consoles) which further exacerbated the cyclicality. Due to this cyclicality, the market has historically punished Nintendo with a discounted valuation against other game publishers.

With the release of the Switch and the online cloud membership (Nintendo Switch Online/Nintendo Account), the company is further pivoting their business model from releasing hit driven consoles into building an online software platform with regular iterative hardware releases.

With shorter product life cycles between each new console release and game releases being backwards compatible, Nintendo’s business model is becoming more like that of Apple’s. Customers can play the same Nintendo games across different Switch products and new console demand will be less cyclical as it will be driven by replacement demand (i.e. I want better performance, graphics, and battery life) rather than creating demand for a completely new console. With less cyclical revenue streams, Nintendo should get a multiple rerating more akin to comparative game publishers.

This has been a business model that Nintendo management have repeatedly alluded to in the past.

“We want to have flexible hardware cycles where the launch of new hardware sets off the development of the next hardware that will respond to consumer trends” Tatsumi Kimishima, former Nintendo CEO, 2017 Investor Call

“Up until now, the hardware cycle has trended at around five or six years, but it would be very interesting if we could prolong that life cycle, and I think you should be looking forward to that” Shigeru Miyamoto, 2018 Investor call

Also for £18/year subscription to Switch Online, the cloud service will allow you to save your game files online and enable game progression across platforms (e.g. between new Switch consoles). From a pricing perspective, subscription costs are extremely competitive versus the equivalent services provided by Microsoft and Sony (£50/year for Xbox Live Gold and £49.99/year for PS Plus).

So far, the subscription has been highly successful; 6 months after release, 28% of all switch users have a subscription. As of H1 FY21, there are over 26 million subscriptions accounting for over 38% of installed user base. Recurring revenue is making up an increasingly larger proportion of total revenue.

Currently, Nintendo has released 2 new iterations of the Switch aimed at attracting different segment consumers with a 3rd new iteration (expected to be called the Switch Pro) scheduled to be released in 2021. Each new release is still similar to the original Switch in terms of functionality however hardware specifications and price will differ depending on the consumer segment it is targeting.

The Nintendo Account also will allow the company to get direct insight into consumer data allowing them to introduce greater value add services onto the platform. This should increase consumer retention and could unlock further potential pricing power for their subscription services (for Switch Online). The company has already introduced a catalogue of 60 legacy NES games onto the platform.

Digitisation and Direct to Consumer

In tandem with the Switch release, Nintendo has also been increasing their digital sales to consumers. Digital sales lag considerably relative to peer game publishers but the difference should lower in time as the benefits are clear: greater convenience to consumers, no wait times etc.

For Nintendo, the economics behind going direct to consumer make a lot of sense: the company can increase margins through skipping out the middle man (brick and mortar retail) and can increase revenue by capturing the retail price for itself. However, the effects are more pronounced depending on the type of game sold.

For first party (Nintendo owns the IP and sell to consumers), there is potential for greater margin expansion as the company bears the costs of manufacturing and distribution itself. For third party games (where external publisher pays a license fee to Nintendo to publish their games on Nintendo consoles), Nintendo only receives the benefit of a higher ASP. Given that over 80% of games sold on Nintendo are first party games, I expect there to be a substantial margin expansion opportunity as Nintendo focuses their efforts on increasing digital sales.

High Quality IP

One of the most distinctive lessons that has come out of the streaming and entertainment wars is the primacy of high quality original IP. With many entertainment and technology companies trying to capture your attention and differentiate their value proposition to consumers, this will become more important as time goes on.

Over its lifetime, Nintendo has cultivated and owns some of the most valuable entertainment IP. Pokémon, Nintendo’s golden goose, is the highest grossing media franchise globally along with other multi-billion dollar IP such as Mario, Donkey Kong and Legend of Zelda. In an iconic 1990s US survey, Mario was more recognisable to American children than Mickey Mouse!

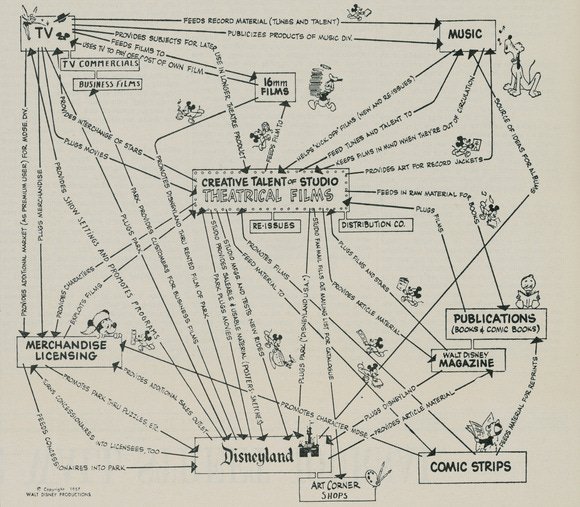

With the exception of Pokémon, the vast majority of these sales have come from the sale of video games. However, as we have seen many times across Disney’s history, great IP translates well across other mediums as long as the execution is good.

In fact, this was so pivotal to Disney’s business model that, in 1957, Walt Disney visually outlines the economic moat of their business. The picture below depicts Disney films as the pivotal attraction for new customers upon which they would interact with other segments of the Disney universe generating greater value for the consumer and strengthening the brand itself. Nintendo is currently attempting to do the same thing with video games at the centre of its moat.

Recent partnerships with Comcast to open three Nintendo-based theme parks by 2022, a collaboration with Illumination Entertainment (makers of the Despicable and Minions franchise) to make a Mario movie as well as efforts to expand the merchandising revenue are all attempts are creating a virtuous flywheel for their IP.

In these licensing agreements, Nintendo shoulders none of the capital expenditure/development costs which limit any downside that could occur. On the upside, they will receive performance based license fees which scale depending on the success of each partnership. Although the details of these partnership agreements are unlikely to disclosed, royalty revenue is extremely high margin and is consistent over time.

Whilst Nintendo has tried to license out its IP in the past (the Legend of Zelda tv series and 1993 Mario movie flops come to mind), the company was hesitant to exert creative control over the contents. Miyamoto (maker of Mario) has talked about this in the past – “the movie may have tried to get a little too close to what the Mario Bros. video games were. And in that sense, it became a movie that was about a video game, rather than an entertaining movie in and of itself”.

Nintendo has likely learnt from these mistakes and are taking a more active approach with their partnership. With Miyamoto now the producer of the new Mario movie, there’s greater chance that Nintendo can successfully expand their IP beyond just video games.

Changing of the guard

After the terrible performance of the Wii U launch, Nintendo set about reorganizing its senior executives. From this, there have been a few beneficial changes to their corporate governance approach.

Performance based compensation has been introduced that is based upon consolidated operating profits and is capped at ¥800m ($7m) for 2020. I would personally like to see more disclosure around company cross holdings as it may be beneficial to unlocking any hidden asset value within the company’s balance sheet– the company has taken steps to simplify its cross holding structure somewhat with its majority stake sale of the Seattle Mariners in 2016 (it still, however, retains a 10% stake).

Transparency has been improving but is still lacking in my eyes - the company still doesn’t disclose private company stakes amounting to less than 20%. New senior management are still all Nintendo-lifers; I fear they may lack the fresh perspective an outside hire could provide to bring about lasting change in the company. A positive sign is the involvement of activist hedge fund, Valueact, with their 2% stake in the company.

Management clearly do care a lot of the company. When sales of Wii U and 3DS plummeted, the CEO and senior executives cut their salary by 50% rather than deciding to cut their workforce. This shows that there is alignment of incentives between shareholders and senior executives as they share in both the upside and the downside.

In terms of capital allocation, the company has retained a large amount of cash on the balance sheet in case of an extended downturn in the console cycle.

Given the structural changes that Nintendo are undergoing, management have started to realise that there is no longer a need to hold such a larger amount of cash on the balance sheet. Over the past ten years, management have been steadily lowering cash levels and returning it back to shareholders in the form of rising dividends and opportunistic share buybacks. I assume that cash levels to continue to trend down in the future (in my model I assume cash and short term investments fall to 52% over the next 5 years with the surplus cash being used to buy back shares).I still expect a large proportion of the cash to be retained on the balance sheet – this is still a Japanese company after all!

Exploring New Markets

Despite Nintendo’s experience within the video game market, there are still plenty of opportunities to expand their revenue geographically. Sales from China (included in Other) account for a very small sliver of total revenues. This has been due to 15 year game console ban that was only lifted in 2015. Since then, the company has slowly become more receptive about venturing into new markets such as China. Efforts increasing China sales have been lacklustre due to lack of experience marketing within the region. Any potential success attracting the 640 million Chinese gamers onto the Nintendo platform will have a significant impact on finances.

In 2019, they partnered with Tencent to sell the Switch console in China. Only 3 titles have been authorised for sale by the Chinese government so far. Although uptake in China is likely to be slow in the initial years, this marks a significant step by Nintendo in accessing the largest gaming region (c. 30% market share). Tencent’s Wechat platform and historical success of tapping into the Chinese gaming market should extend towards this partnership. Releases of future game titles will further enhance the Switch game library, encouraging growth in hardware sales in the region.

In 2015, Nintendo has started to dip its toes into the fastest growing segment of the gaming market; mobile games. The market potential for Nintendo is huge; there are approximately 1.4bn mobile gamers worldwide and, according to Newzoo, the market is expected to grow at 9.9% until 2023.

The aim is to release 1 or 2 titles for mobile every year. Monetization rates have underperformed relative to other mobile publishers and currently, mobile accounts for c.4% of total sales. However, mobile margins are high and, with more experience under their belts, monetization should meaningfully improve with future releases.

In order to target the Chinese mobile gaming segment (which occupies c.65% of Chinese market), Nintendo is partnering with Timi Studios (Tencent’s in-house gaming studios) to create Pokémon Unite. The freemium game will be cross compatible between mobile and the Switch and hopes the leverage the Pokémon IP to encourage Chinese consumer onto the Nintendo ecosystem.

Tencent have been extremely successful at monetizing Honour of Kings with an estimated player spending of $15/download since launch. If Pokémon Unite can attract 20% of total downloads of Honour of Kings (60m) and improve their monetization to $5/download, the game will generate around $300m revenue (which would be a huge success compared to Nintendo’s other mobile game releases).

Pokémon Unite is scheduled to be release late 2020/early 2021 and I also expect the cross compatibility feature to bring a meaningful uplift in sales of the Switch going forward.

Hidden Asset Value

As is customary with Japanese companies, Nintendo holds stakes in many different companies and due to the vagaries of Japanese financial reporting, these aren’t explicitly revealed in the balance sheet. Their largest asset is their 32% ownership of the Pokémon Company, consolidated under the equity method of accounting, and is jointly owned by Game Freak and Creatures. Nintendo has effective control over distribution of Pokémon games whilst paying a small license fee to TPC. There are suggestions that Nintendo own stakes in Creatures and Game Freak, which should increase their ownership stake in TPC. However, as Nintendo refuses to disclose their stakes in private companies, I am only attributing value to the 32% stake. This article (LINK) goes into this in more detail.

Not to mention their 10% stake in the Seattle Mariners, 10% stake in DeNa, 1.75% stake in Bandai Namco and 13% stake in Niantic (maker of top selling augmented reality app Pokémon Go), these basket of assets account for roughly 1500 JPY/Share. Cash on the balance sheet also accounts for over 15% of the current market value.

Valuation:

Given that Nintendo owns an eclectic combination of assets, Sum of the Parts valuation seems to be the most viable option here.

Regarding differentiation from consensus, I believe I differ in 2 ways:

Use of total sales/hardware unit sold vs. attach rate (no. of software units/hardware units sold)

Traditionally the sell side uses attach rate (software units / hardware units) and software price as drivers for the business. However, this fails to take into account the higher software revenue per unit generated as digital and recurring sales making up a larger proportion of software sales. A more appropriate driver to value the company would be total sales/hardware units.

Assuming that revenue per software unit sold doesn’t increase:

Sell side fail to take into account that Nintendo generates higher revenue per unit of software sold (they internally capture the mark-up that brick and mortar stores would traditionally get) as they typically assume a constant software price.

Factoring this in, my base case scenario assumes:

- Total installed base of switch players reach to c. 145 million (below that of the DS console).

o This is higher than the Wii due to its appeal across portable and home console players and penetration into the Chinese player base.

- Switch online member increases from 33.4% in H1 FY20 to 50% of total installed player base by FY25. Switch online membership price stays constant.

- Digital sales increase 47.2% to 70% by 2025.

- Mobile and IP revenue increases by 52% CAGR until 2025.

- EBIT margin expansion by 14% due to higher sales mix from digital software, switch online subscription member and mobile revenue.

- Company uses c.13% of its cash balance to buy back shares every year.

Based on my base case thesis, I assume a slight EV/EBITDA multiple expansion from 12x to 14x given that revenue streams will become less cyclical going forward. This is still significantly below US game publisher’s (ATVI, EA, UBI, and TTWO) historical average of 20x. The end result is still a roughly 40% margin of safety on my base case.

On a probability weighted basis (factoring my own three valuation scenarios), I get a 13.7% 5 year IRR which includes the 2.99% dividend yield offered at the current price.

Risks

- Potential further delays to Theme Park Openings

- Poor execution risk around Mario Movie

- Death of Shigeru Miyamoto – can Nintendo survive the death of its creative director and the maker of Mario, Legend of Zelda and Donkey Kong franchise?

Catalysts:

- Switch Pro Release

- Pokémon Unite Release

- Sales of stakes in other companies

- Value realisation of private company stakes (Niantic IPO)

- Theme Park Openings

LET'S PLAY MARIO

This is fantastic. Best piece on Nintendo I've ever read. I have read A LOT!